Debt Snowball vs Avalanche

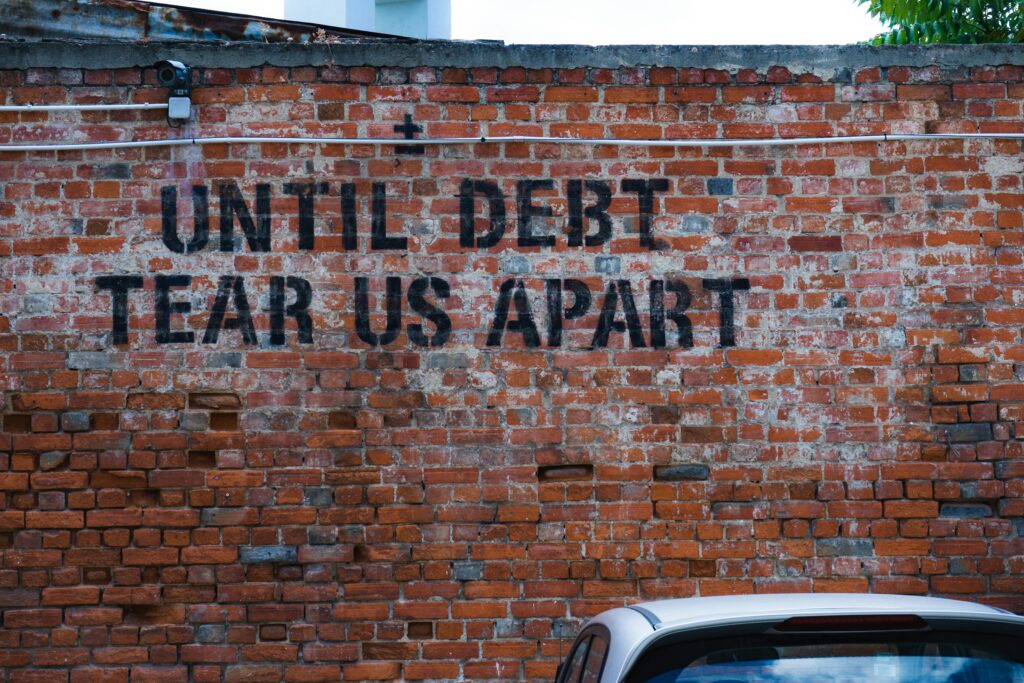

Debt has a way of creeping up on you. One day, you’re just using your credit card for a couple of small purchases. Then suddenly, you’re juggling five different payments, drowning in interest, and wondering how you got here. If this sounds familiar, you’re not alone. In fact, the average American carries over $5,000 in credit card debt, with many struggling under the weight of student loans, car payments, and personal loans.

But there’s a way out—and two of the most effective methods are the Debt Snowball and the Debt Avalanche. Both work. Both will get you out of debt. But which one is right for you? Let’s break them down so you can finally ditch debt for good.

The Debt Snowball Method: Paying Small Wins First

The Debt Snowball method is simple: you pay off your smallest debts first, regardless of interest rates.

Here’s how it works:

🔹 Step 1: List all your debts, from smallest to largest.

🔹 Step 2: Make minimum payments on all debts except the smallest one.

🔹 Step 3: Throw all extra cash at the smallest debt until it’s gone.

🔹 Step 4: Once the smallest debt is paid off, roll that payment into the next smallest debt.

🔹 Step 5: Repeat the process until all your debts are gone.

Why People Love the Debt Snowball Method

The reason this method is so effective isn’t just about numbers—it’s about motivation.

- Quick wins keep you motivated.

- You see progress immediately.

- Paying off entire debts feels rewarding, which keeps you going.

Example: Sarah has the following debts:

• $500 credit card (24% interest)

• $2,000 medical bill (0% interest)

• $7,000 car loan (5% interest)

• $10,000 student loan (6% interest)

Even though the credit card has the highest interest, the Debt Snowball method tells her to pay off the $500 debt first. Why? Because knocking out that first debt quickly builds momentum and gives her a psychological boost. Once she pays off the $500 card, she can roll that payment into the next debt, then the next, until she’s completely debt-free.

The Debt Avalanche Method: Tackling High-Interest First

The Debt Avalanche method focuses on interest rates rather than debt size.

Here’s how it works:

🔹 Step 1: List all your debts by interest rate, from highest to lowest.

🔹 Step 2: Make minimum payments on all debts except the one with the highest interest.

🔹 Step 3: Throw all extra cash at the highest-interest debt first.

🔹 Step 4: Once that debt is paid off, move to the next highest-interest debt.

🔹 Step 5: Keep going until you’re debt-free.

Why the Debt Avalanche Saves You More Money

This method is all about math and efficiency. When you break it down, it’s the fastest way to pay off debt in terms of total cost savings. Why? Because you pay less interest over time by eliminating high-interest debts first. If you’re disciplined, you’ll get out of debt sooner than with the Snowball method.

Example: Let’s use Sarah’s debts again.

• $500 credit card (24%)

• $2,000 medical bill (0%)

• $7,000 car loan (5%)

• $10,000 student loan (6%)

Using the Debt Avalanche, Sarah would start with the credit card first because it has the highest interest. Once that’s gone, she moves to the student loan (6%), then the car loan (5%), and finally the medical bill (0%). This method saves her money in the long run because she’s eliminating the most expensive debt first.

Debt Snowball vs Avalanche: Which One is Best for You?

Both methods work, but the best choice depends on your mindset and financial situation.

| Choose This If… | Debt Snowball | Debt Avalanche |

|---|---|---|

| You need motivation to stay on track | ✅ Yes | ❌ No |

| You want to pay the least amount of interest | ❌ No | ✅ Yes |

| You prefer seeing small wins quickly | ✅ Yes | ❌ No |

| You’re disciplined with money & numbers | ❌ No | ✅ Yes |

| You have high-interest debt | ❌ No | ✅ Yes |

| You need a clear, structured plan to follow | ✅ Yes | ✅ Yes |

Still not sure? Combine both methods. Start with the Debt Snowball to build motivation, then switch to the Avalanche once you’ve built better financial habits. At the end of the day, either method (or both!) is a million times better than not having a plan at all.

If you want to see more side-by-side examples of how these different strategies work, check out the Fidelity comparison.

The One "Trick" to Paying Off Debt Faster

No matter which method you choose, there’s one simple strategy that can cut years off your debt repayment.

Make Biweekly Payments. Instead of making one monthly payment, split it into two smaller payments every two weeks.

🔹 Why does this work?

- You end up making one extra full payment per year.

- You reduce total interest paid.

- You pay off debt months—or even years—faster.

Example: If your car loan payment is $400 per month, making $200 payments every two weeks means you’ll pay off the loan faster without feeling the extra financial strain.

Final Thoughts: Choose a Debt Plan & Take Action

As seems to be the theme here, taking action is much better than not taking any action at all. The best debt payoff method is the one you’ll actually stick with. Don’t spend too much time dwelling on it. Starting is the best move.