Long Term vs Day Trading Crypto

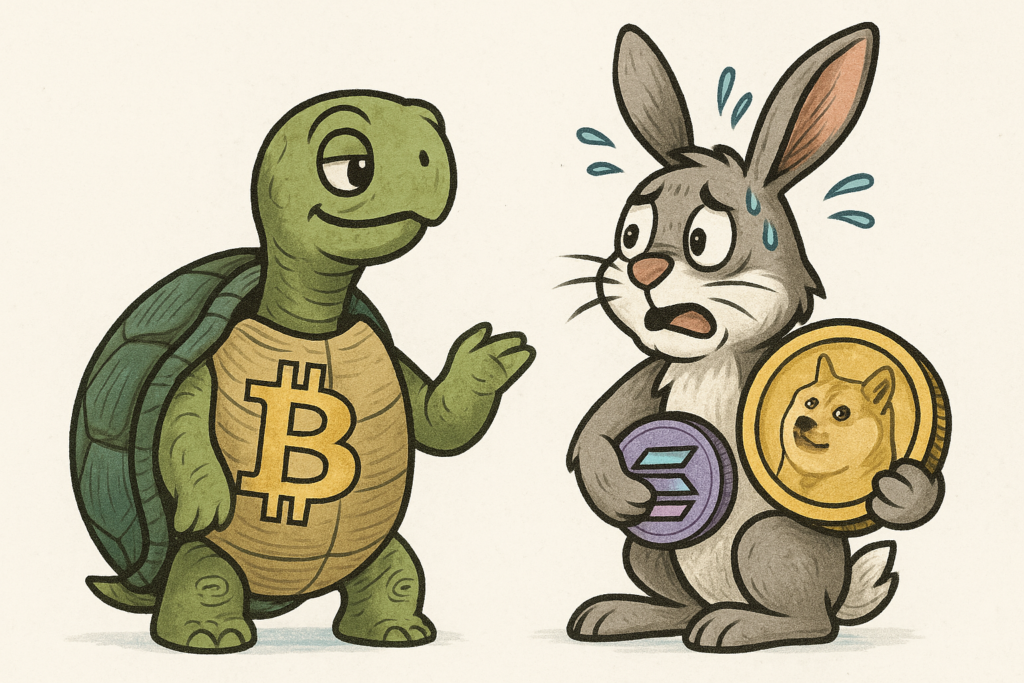

In the world of crypto, everyone wants to be a genius.

Maybe you know the guy who brags about flipping Solana in a weekend for 40%. Or the Reddit hero who got in on Dogecoin before the first Elon tweet. But for every success story shared at parties, there are a hundred others we don’t hear—wallets emptied by bad timing, high emotions, and trades that went sideways before lunch.

The truth? There are two main ways people approach the crypto market:

- The fast-paced, adrenaline-fueled grind of day trading

- The calmer, long-view strategy of long-term investing

Both paths have their pros, pitfalls, and personality fits. Let’s walk through both—honestly—and help you figure out which one might actually help you grow your wealth without losing your mind.

What is Day Trading Crypto?

Day trading is the art (and sometimes chaos) of buying and selling crypto within short windows—sometimes within minutes or hours. The goal is to profit from small price movements multiple times per day.

Picture someone with three monitors open, charts blinking in real time, executing trades based on technical patterns, gut instinct, or the latest tweet from a crypto influencer.

Sounds exciting? Sure. But it’s also:

- Mentally draining

- Time-consuming

- Risk-heavy, especially with a market as volatile as crypto

Prices can swing 10% in an hour based on a rumor—or a regulatory headline. That volatility creates opportunity, but it also creates chaos.

Most beginner day traders? They don’t outperform the market. In fact, they often get eaten alive by fees, slippage, and emotional decision-making.

What is Long-Term Crypto Investing?

Long-term investing is a different beast. Instead of jumping in and out of coins chasing micro-wins, long-term investors pick a handful of solid projects—like Bitcoin, Ethereum, or other high-conviction altcoins—and hold them for months or years.

This strategy is often called HODLing in crypto-speak, born from a famous typo in a Bitcoin forum that stuck.

Long-term investors don’t worry about daily dips or short-term hype. They believe the technology will reshape industries—and they’re willing to wait.

It’s less sexy. No daily thrill, no screenshot flexes. But it’s proven far more effective for the average person.

If you bought $1,000 of Bitcoin in 2015 and just let it sit? You’d be up over 20,000% by now.

If you tried to time every peak and valley along the way? Odds are, you’d have gotten shaken out and missed the run.

The Psychology of the Game

Let’s be real: most people lose money not because of bad coins—but because of bad behavior.

Day trading amplifies those behaviors. Fear, greed, FOMO, panic—all are magnified when you’re constantly checking charts and second-guessing yourself.

Long-term investing reduces the noise. It gives your decisions room to breathe. And it respects the reality that you’re not a robot—you’re a human being trying to grow your wealth without turning your life into a stress experiment.

A Quick Comparison

| Strategy | Day Trading Crypto | Long-Term Investing |

|---|---|---|

| Time Needed | High—hours per day | Low—occasional check-ins |

| Risk Level | Very High—fast price swings | Moderate—market cycles apply |

| Skill Curve | Steep—requires technical analysis | Simpler—research + conviction |

| Emotional Load | High—FOMO and panic common | Lower—patience is key |

| Tools Needed | Real-time tracking, indicators | Secure wallet, good exchange |

| Success Rate | Low for beginners | Higher over time |

What About Taxes?

One overlooked factor? Taxes.

Day traders often trigger short-term capital gains, which are taxed at higher rates and can quickly eat into profits.

Long-term holders, on the other hand, may qualify for long-term capital gains rates—which are lower. Holding for 12 months or more before selling could mean a more favorable tax outcome.

Of course, this depends on your location and personal tax situation, so it’s wise to talk to a CPA.

Is There a Middle Ground?

Absolutely. Some people combine both approaches—holding a core long-term portfolio while occasionally trading a small percentage on the side.

That’s a more sustainable hybrid: you get the thrill of market engagement without risking your entire stack.

Just be honest with yourself: are you trading to grow wealth or to chase a dopamine hit?

Our Take at Stackonomics

Here’s where we stand: consistency beats intensity.

Most readers aren’t full-time traders. They have jobs, families, lives. And trying to out-trade a global market running 24/7 with lightning speed and no sleep? That’s a recipe for burnout.

But stacking smart investments over time? That’s powerful. That’s sustainable. That’s Stackonomics. And if you must scratch the trading itch? Use a sandbox budget. Never trade more than you’re willing to lose—and always keep your long-term goals in sight.

Next Steps

Want to start building a long-term crypto plan? Check out: